Earnings - April 15, 2021

Heidelberg, Germany, April 15, 2021 – Affimed N.V. (Nasdaq: AFMD), a clinical-stage immuno-oncology company committed to giving patients back their innate ability to fight cancer, today reported financial results for the year ended December 31, 2020 and provided an update on clinical and corporate progress.

“2020 was an important year for Affimed. We continued to build on the strong foundation of our scientific discoveries and made significant progress across all our programs. We broadened our clinical pipeline, added new collaborations, built a strong balance sheet, appointed key senior management executives and ensured that our programs stayed on track through the global pandemic,” said Dr. Adi Hoess, CEO of Affimed. “We entered 2021 with strong momentum, and the recently announced positive outcome of our interim futility analysis for our registration directed study of AFM13 as monotherapy in PTCL patients, and initial data from the trial investigating AFM13 pre-complexed natural killer cells in Hodgkin lymphoma patients provide further validation for our three-pronged development strategy. As we look ahead into 2021, we anticipate numerous additional updates as we advance our programs.”

Three-pronged Development Strategy

Based on preclinical and clinical data, Affimed is pursuing development of its innate cell engagers (ICE®) as monotherapy, and in combination with adoptive NK cell transfer and PD-1/PD-L1 checkpoint inhibitors.

AFM13 (CD30/CD16A)

AFM24 (EGFR/CD16A)

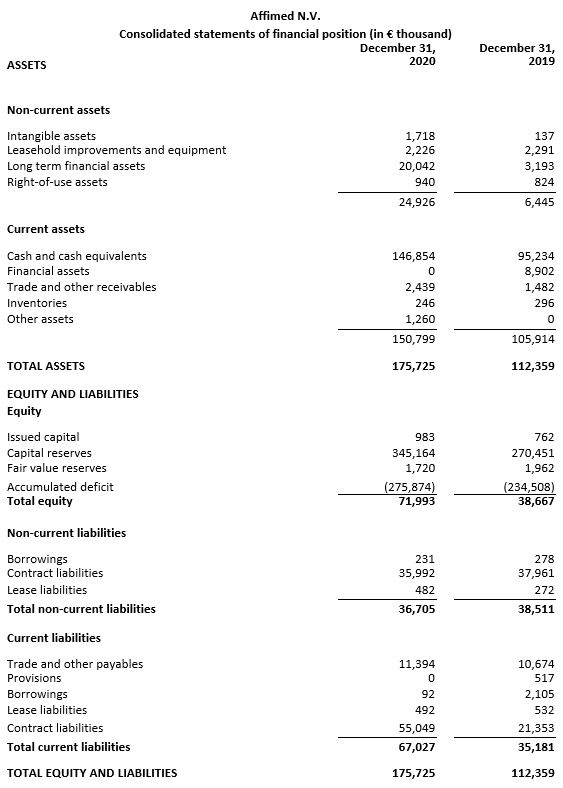

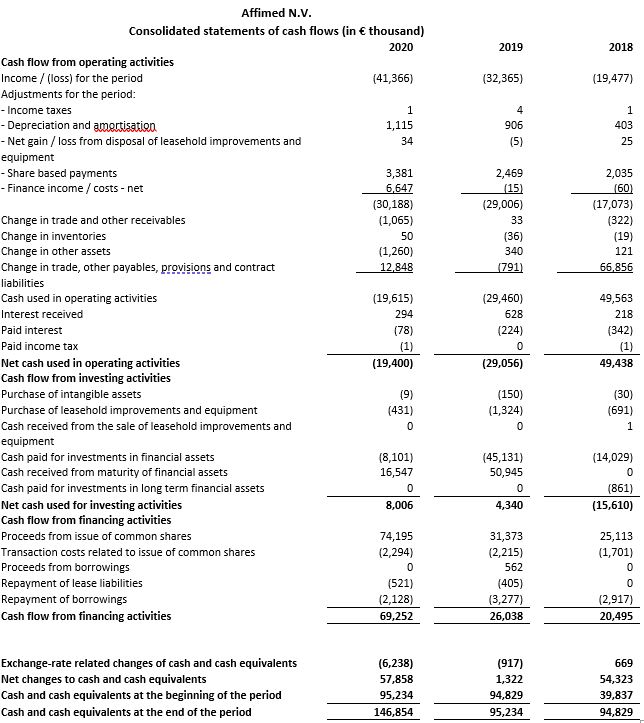

As of December 31, 2020, cash, cash equivalents and current financial assets totaled €146.9 million compared to €104.1 million on December 31, 2019. The pro forma cash position as of December 31, 2020, including net proceeds from the January 2021 underwritten public offering and the first tranche of the Silicon Valley Bank loan, would be approximately €244.5 million.

Based on its current operating plan and assumptions, Affimed anticipates that its cash and cash equivalents will support operations into the second half of 2023.

Net cash used in operating activities for the year ended December 31, 2020 amounted to €19.4 million compared to €29.1 million for the year ended December 31, 2019. The amount received in 2020 includes an initial upfront payment and committed funding of €33.3 million (US$ 40 million) from the Roivant collaboration.

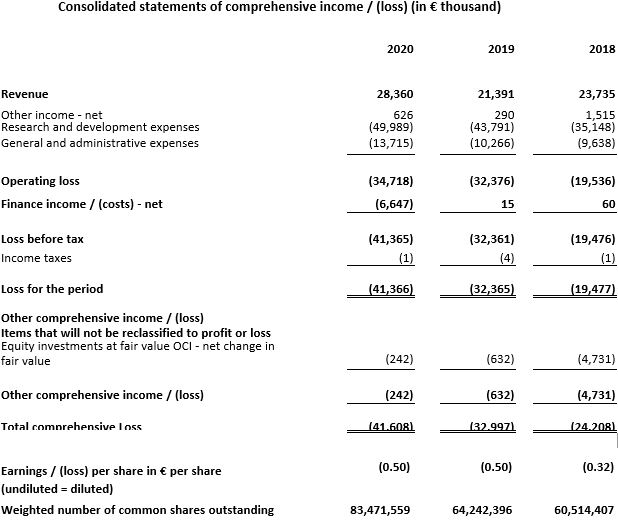

Total revenue for the year ended December 31, 2020 was €28.4 million compared with €21.4 million for the year ended December 31, 2019. Revenue for 2020 and 2019 predominantly relate to the Genentech collaboration. Collaboration revenue for the year ended December 31, 2020 amounted to €27.8 million, with €26.2 million from the Genentech collaboration and €1.4 million from the Roivant collaboration. Collaboration revenue of €19.7 million for the year ended December 31, 2019 was from the Genentech collaboration.

Research and development expenses for 2020 increased 14.2% from €43.8 million in the year ended December 31, 2019 to €50.0 million in the year ended December 31, 2020, due to higher expenses for AFM24 and our other projects and infrastructure investments.

General and administrative expenses increased 33.6% from €10.3 million in the year ended December 31, 2019 to €13.7 million in the year ended December 31, 2020. In 2020, general and administrative expenses were largely comprised of personnel expenses of €6.3 million and legal, consulting and audit costs of €5.6 million.

Finance costs for the year ended December 31, 2020 were €6.6 million, compared to finance income of €15 thousand for the year ended December 31, 2019. Finance costs for the year ended December 31, 2020 were largely comprised of foreign exchange losses related to assets denominated in U.S. dollars as a result of the weakening of the U.S. dollar compared to the Euro during the year.

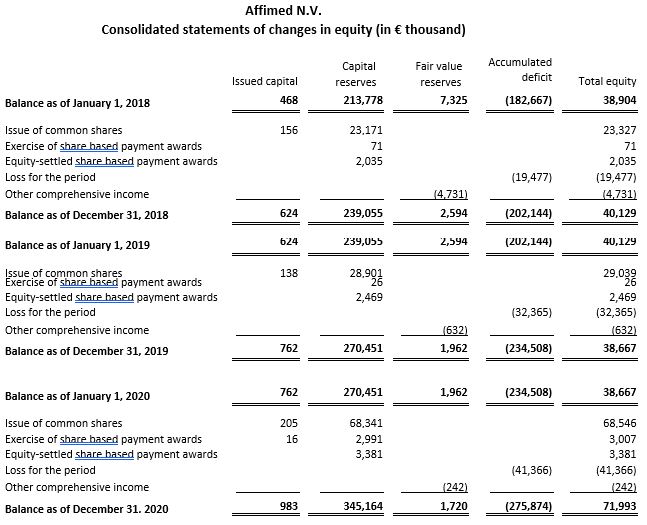

Net loss for the year ended December 31, 2020 was €41.4 million, or €0.50 per common share compared with a net loss of €32.4 million, or €0.50 per common share, for the year ended December 31, 2019.

The weighted number of common shares outstanding for the year ended December 31, 2020 was 83.5 million.

Additional information regarding these results is included in the notes to the consolidated financial statements as of December 31, 2020 and “Item 5. Operating and Financial Review and Prospects,” which will be included in Affimed’s Annual Report on Form 20-F as filed with the U.S. Securities and Exchange Commission (SEC).

Affimed prepares and reports consolidated financial statements and financial information in accordance with IFRS as issued by the International Accounting Standards Board. None of the financial statements were prepared in accordance with Generally Accepted Accounting Principles in the United States. Affimed maintains its books and records in Euro.

Affimed will host a conference call and webcast today, April 15, 2021 at 8:30 a.m. EDT to discuss fourth quarter 2020 financial results and recent corporate developments. The conference call will be available via phone and webcast.

To access the call, please dial +1 (646) 741-3167 for U.S. callers, or +44 (0) 2071 928338 for international callers, and reference passcode 4271307 approximately 15 minutes prior to the call.

A live audio webcast of the conference call will be available in the “Webcasts” section on the “Investors” page of the Affimed website at https://www.affimed.com/investors/webcasts_cp/. A replay of the webcast will be accessible at the same link for 30 days following the call.

Affimed (Nasdaq: AFMD) is a clinical-stage immuno-oncology company committed to giving patients back their innate ability to fight cancer by actualizing the untapped potential of the innate immune system. The company’s proprietary ROCK® platform enables a tumor-targeted approach to recognize and kill a range of hematologic and solid tumors, enabling a broad pipeline of wholly-owned and partnered single agent and combination therapy programs. The ROCK® platform predictably generates customized innate cell engager (ICE®) molecules, which use patients’ immune cells to destroy tumor cells. This innovative approach enabled Affimed to become the first company with a clinical-stage ICE®. Headquartered in Heidelberg, Germany, with offices in New York, NY, Affimed is led by an experienced team of biotechnology and pharmaceutical leaders united by a bold vision to stop cancer from ever derailing patients’ lives. For more about the company’s people, pipeline and partners, please visit: www.affimed.com.

This press release contains forward-looking statements. All statements other than statements of historical fact are forward-looking statements, which are often indicated by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “goal,” “intend,” “look forward to,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions. Forward-looking statements appear in a number of places throughout this release and include statements regarding our intentions, beliefs, projections, outlook, analyses and current expectations concerning, among other things, the potential of AFM13, AFM24, and our other product candidates, the value of our ROCK® platform, our ongoing and planned preclinical development and clinical trials, our collaborations and development of our products in combination with other therapies, the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for our product candidates, our intellectual property position, our collaboration activities, our ability to develop commercial functions, clinical trial data, our results of operations, cash needs, financial condition, liquidity, prospects, future transactions, growth and strategies, the industry in which we operate, the trends that may affect the industry or us, impacts of the COVID-19 pandemic, the benefits to Affimed of orphan drug designation and the risks, uncertainties and other factors described under the heading “Risk Factors” in Affimed’s filings with the SEC. Given these risks, uncertainties, and other factors, you should not place undue reliance on these forward-looking statements, and we assume no obligation to update these forward-looking statements, even if new information becomes available in the future.

Alexander Fudukidis

Director, Head of Investor Relations

E-Mail: a.fudukidis@affimed.com

Tel.: +1 (917) 436-8102